An equity title loan lets you borrow money against the value of your vehicle. Unlike a traditional title loan, you don’t need to own your car outright to take out an equity title loan. Your approved loan amount will depend on various factors, including the equity you have in your car.

Equity in a car is the difference between the amount you owe, and the current market value of your vehicle. For example, if your car is worth $10,000 and you owe $2,000 on your auto loan, the equity is $8,000. We will use this equity to determine the amount you can borrow as a title loan. Unlike a traditional title loan, equity loans can offer longer repayment periods and may have a lower interest rate.

To take out an equity title loan, the process generally consists of the following:

- Complete your loan & receive a fast decision regarding approval

- Review & sign your documents, and receive cash your way. This includes either cash in hand or a deposit directly to your bank account/debit card.

- Pay back your loan as defined in your agreement.

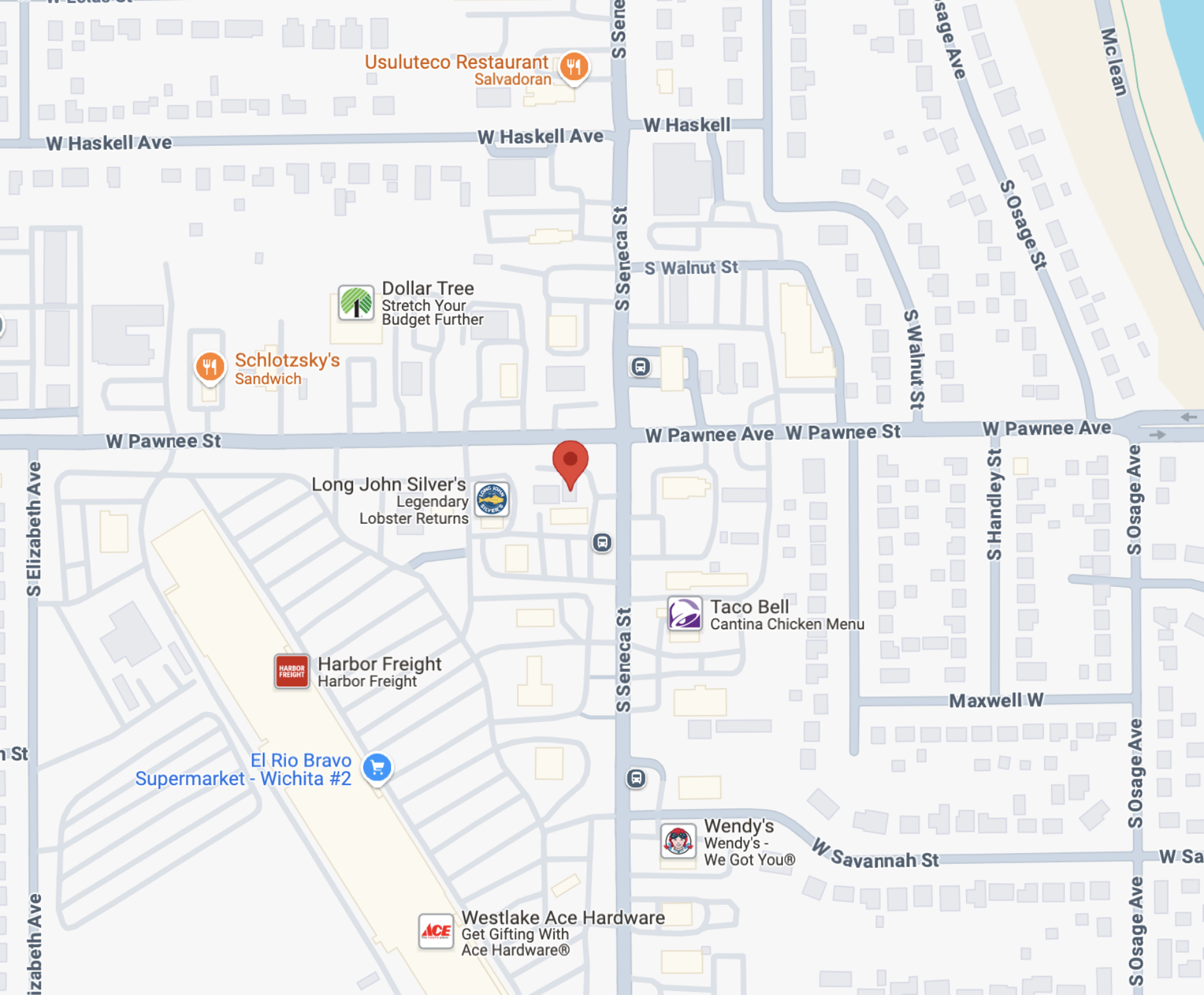

Have questions about equity and title loans? Call our team or visit our store in person. Our streamlined system is designed to save you time, and following your initial in-person visit with your ID, you can manage your loan completely online for your convenience.